With property prices down, many armchair investors are thinking about getting up and making an offer.

With property prices down, many armchair investors are thinking about getting up and making an offer.

Whether you’re investing in residential real estate, a small strip shopping center, a commercial office building, a warehouse property, or raw land, the first thing you need to do is figure out how to value the property. Only then can you make a savvy offer to purchase.

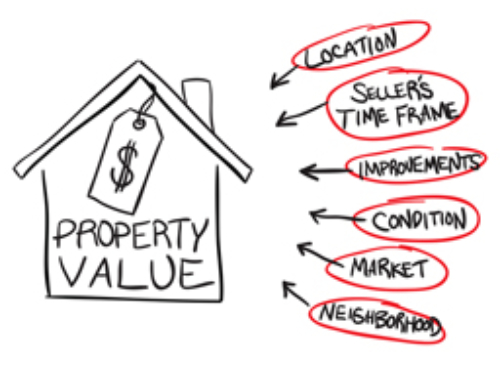

Whether you’re going to live in it or rent it out, when it comes to residential real estate, value is based on what everyone else has paid for similar properties in the neighborhood. To that you add or subtract based on the property’s condition, amenities, and specific location within the neighborhood.

But how do you value investment property? The primary way real estate investors value investment property is by looking at the annual net operating income generated by an investment property and then calculating the capitalization rate, or cap rate.

The formula for calculating the cap rate is as follows:

Annual Gross Rental Income – Annual Net Operating Expenses = Annual Net Operating Income

Cap Rate = (Annual Net Operating Income/Purchase Price) x 100

As I discuss in my book Buy, Close, Move In!, if your broker tells you a property has a cap rate of 10, it means that the property is priced at ten times the net operating income. Here’s an example from the book: Let’s say you purchase a property for $1 million that generates $150,000 in revenue per year. If the property’s expenses are $50,000, your net operating income is $100,000. Divide $100,000 by $1 million, and you have 0.10. Multiply by 100, and you have a cap rate of 10.

Ideally, you’ll have the highest possible cap rate on a property, because the higher the cap rate, the more profitable the property.

The challenge for many first-time real estate investors is they don’t know how to verify the income generated by the property or the expenses the owner incurs to keep the property maintained and upgraded.

One way to do this is to request a copy of all the leases for the property as well as a building budget. Typically, this step comes after you’ve made an offer, but not always.

When you look at the leases, you’ll want to verify the rent the tenant pays each month, what expenses the tenant pays, and how much time is left on the lease. You don’t want to find out at closing that the tenant’s lease expires in a month.

Once you find out how much the tenant is paying, you can start shopping around the lease to determine if you can raise the rent, and by how much. While the tenant’s current rent might be enough to pay the current owner’s mortgage, it may not be enough to support yours or meet your revenue requirements.

While you can peruse the building documents on your own, I suggest you put together a team of experts who can assist you along the way. This real estate investment team should include a top real estate agent[IG2], a professional property inspector (who specializes in the type of investment property you’re purchasing), a real estate attorney, a mortgage lender, and a tax preparer.

Your experts will help you not only read between the lines but also make sure that the value you ascribe to a particular investment property is really there.

Ilyce Glink is a best-selling author, real estate columnist, and web series host. She is the managing editor of the Equifax Finance Blog and CEO of Think Glink Media. Follow her on Twitter: @Glink