How to Save More Money at Home

How to Save More Money at Home

According to a recent Pew Research Center survey, some 55 percent of Americans have seen their household income fall or—in the case of those who have lost their job—evaporate.

If you’re bringing home less than you were, there are only two ways to make up the shortfall: earn more or spend less.

Earning more is tough in an economy that’s short about 8 million jobs. According to the latest surveys from the Commerce Department, there are five people searching for every job that’s available.

There’s not much to like in those odds.

So if you can’t earn more money, you’ve got to focus on saving more money. Since this is a real estate blog, let’s talk about how you can save more money at home.

Save More: Utility Bills

Estimated Savings: $50 to $100+ per month

You might not be able to do much about your sewer service and garbage pickup, but when it comes to water, energy, cable, and telephone services, you should be able to save more money if you take steps to reduce usage, figure out exactly what you need, and shop around carefully.

Water: Install water flow reducers in all showerheads, and limit showers to just a few minutes. Don’t let the water run when you’re brushing your teeth. Consider using a time-based sprinkler system.

Energy: Turn off lights in your house when they’re not in use and replace incandescent bulbs with CFLs. Use a programmable thermostat and set it two degrees warmer in the summer and two degrees cooler in winter.

Cable: Consider eliminating everything except basic cable. If you’re already at basic cable, consider eliminating that for six months.

Phone/Wireless: Think carefully about how much you use your cell phone and whether you can live without your landline. MyRatePlan.com can help you figure out if you’re getting the wireless phone rate plan that you need.

Extra tip: You may get a better deal if you bundle your cable, online, and phone services. Just don’t get suckered into buying more than you need.

Save More: Mortgage, Real Estate Taxes, and Homeowner’s Insurance

Estimated Savings: $25 to $50 per month, or more

Mortgage: Mortgage interest rates are at a fifty-year low, but mortgage standards have become much stricter even as household credit scores are falling. To qualify, you’ll need a great credit score, solid income, low debt, and (perhaps the toughest for many families at the moment) enough equity in your home. But if you could lower your mortgage interest rate from 5.675 percent to 4.5 percent, you’d save more than $75 per month for every $100,000 financed.

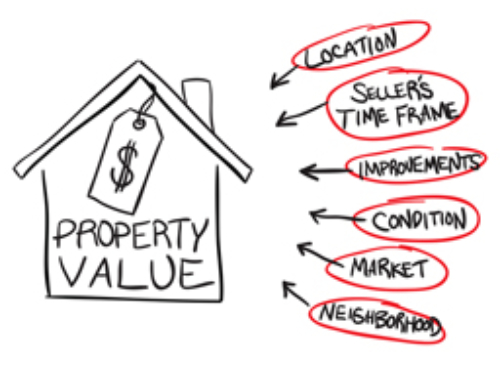

Real Estate Taxes: If you’ve never contested your property taxes, now is the perfect time to start. Property prices have been falling across the country for the past two years, so contesting your property taxes may net you a savings of a few hundred or even a few thousand dollars a year.

Here are two effective ways to contest your property taxes: Compare your property (and the taxes you’re paying) to other similar properties in your home’s tax class. Or, if you recently purchased your property, you can contest the taxes owed based on the market value (this is helpful when you’ve purchased a foreclosure or short sale). If you need additional help, there are attorneys who specialize in contesting real estate taxes and who will do this for you for a percentage of whatever savings they can get.

Homeowner’s Insurance: If you haven’t shopped around for homeowner’s insurance in a while, you should do it now. Linda Rey, our Equifax Insurance blogger, offers tips on saving money and getting the coverage you need.

Save More: Regular Home Maintenance

Estimated Savings: $50 to $250 per month

If you’ve got more time than money and you’re hiring out to do some regular home-maintenance chores, you might want to think about tackling some of these chores yourself and pocketing the savings.

For example, you can mow your own lawn ($25 to $35 saved per week, in season), shovel your own snow ($50 to $100 per storm), clean your own gutters ($85 to $200 per cleaning), and act as your own handyman ($50 to $75 per hour).

Paint and brushes are inexpensive, and there are plenty of videos online (including this video that I produced on painting your bathroom) that will show you how to do a paint job that looks like a pro did it.

My husband, Sam, has changed out faucets and toilets, replaced faulty switches, and rewired lamps. He mows the yard and I weed, and together we rake the leaves. I estimate that we’ve saved at least $100,000 in expenses over our twenty-plus years together just by doing some of these regular home-maintenance chores ourselves.

The bottom line is you really can save more money at home. How are you saving money at home?

Ilyce Glink is a best-selling author, real estate columnist, and web series host. She is the managing editor of the Equifax Finance Blog and CEO of Think Glink Media. Follow her on Twitter: @Glink