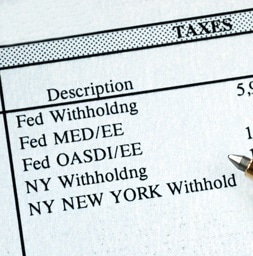

A client just asked me about reviewing her payroll, which fluctuates a great deal throughout the year. Her request is perfectly timed—there’s still plenty of time to adjust her withholding before year-end and filing taxes.

A client just asked me about reviewing her payroll, which fluctuates a great deal throughout the year. Her request is perfectly timed—there’s still plenty of time to adjust her withholding before year-end and filing taxes.

When you pay your taxes via withholding, the IRS will treat the payments as if they had been made throughout the year—even if you apply your entire last paycheck or two to withholding. This way you can avoid the late payment penalties on estimated tax payments that should have been made during the first two or three quarters of the year.

Why adjust your withholding? Ask yourself the following.

1) Did your personal circumstances change? Your withholding may be too low. It’s tough to come up with a big chunk of money on April 15. It’s easier to have a few extra bucks deducted from your paycheck for the next pay periods.

2) Did you learn that you have a big refund coming up? Your withholding may be too high. You must have a dozen uses for that money right now, so reduce your withholding. Then bank that money, or use it to pay off bills.

3) Do you have a business on the side? Many people do. If you love that business, you’re probably making nice profits. You should have been making estimated tax payments all year to cover income and self-employment taxes on those profits. You can avoid the penalties by increasing the withholding from your paycheck to cover the estimated tax payments you’ve missed.

4) Do you have a household employee? Maybe you didn’t quite realize that the person helping care for your parent or child should have been on payroll all year. You still have time to fix the problem and catch up. (Work with a tax pro on this one.) You can fund the payments to the IRS by increasing your payroll deductions. You must still file all the relevant paperwork, and you will also need to register with your state.

5) Did you collect unemployment benefits earlier in the year without realizing they were taxable? You may need to increase both IRS and state withholding.

6) Is your Social Security income (SSI) taxable? Up to 85 percent of SSI could be taxed when you have other income. Work out your liability now. Adjust your withholding on your SS benefits, your pension, or your wages, if you’re still working.

7) Did you win a prize? Don’t forget that what you win is taxable. For example, you should have been given a Form 1099-MISC or a W-2G if you were gambling at a casino. It’s up to you to pay taxes on prizes, and you may want to adjust your withholding to cover them.

How can you compute your taxes due?

There are several tax withholding calculators online, but they don’t really offer a full computation that includes such things as self-employment taxes and alternative minimum taxes. It’s a good idea to work with a tax professional at this time. Your tax pro can give you tips to reduce your taxes before the end of the year, too.

You’d rather do it yourself? Use the latest version of live online tax software. Systems like this will let you enter data, and as long as you don’t try to print or file the tax return, you won’t pay a dime.

READ MORE:

Best Tax Tips: The Tax Effects of School Supplies and Courses

2012 Standard Mileage Rate: How it affects Your Business Vehicle

Entrepreneurs and Start-Ups: Best Tax Tips

August 2011 Summer Tax-Free Days

Common Mistakes the Self-Employed Make

How Divorce Affects Your Tax Return

Sales Tax – Are All Those Receipts Worth Saving?

Eva Rosenberg, EA is the publisher of TaxMama.com , where your tax questions are answered. Eva is the author of several books and ebooks, including the new edition of Small Business Taxes Made Easy. Eva teaches a tax pro course at IRSExams.com and tax courses you might enjoy at http://www.cpelink.com/teamtaxmama.