At my 20th high school reunion, I learned that one of my classmates was homeschooling her two children. I was fascinated with the concept, though my main concern was about her children’s socialization with others their own age. No worries here—her children were actively involved with their own age group in church and in clubs.

At my 20th high school reunion, I learned that one of my classmates was homeschooling her two children. I was fascinated with the concept, though my main concern was about her children’s socialization with others their own age. No worries here—her children were actively involved with their own age group in church and in clubs.

Clearly, by educating your own children your way, you can shield them from a variety of bad influences, give them an amazing education, and still have them grow up to be balanced people with good social skills. But are there any tax issues or benefits available for folks who homeschool their children?

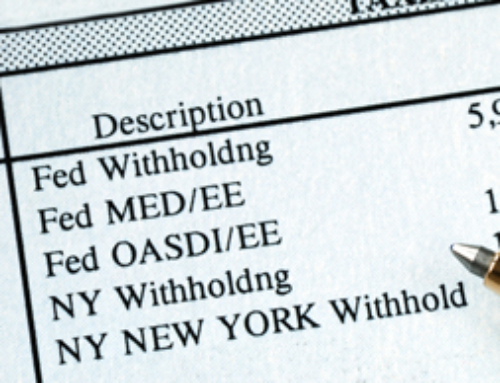

Since home schools and teachers are chartered at the state level, let’s start by looking at the state level.

What tax benefits do states offer for homeschooling families?

Several states offer educational tax credits to reimburse parents for the cost of their children’s schooling. Generally, the parents must be paying the money to accredited educational institutions to get the benefit of the credits. The Home Schooling Legal Defense Association has helpfully pulled together a summary of tax credits available by state.

Using ESA funds when homeschooling

Folks who have been funding a Coverdell Education Savings Account (ESA, also known as an education IRA) may be allowed to use those funds to cover the cost of homeschooling. In states where home schools or groups of home schools are recognized as private schools, ESA funds may be drawn to pay those expenses.

You may use the ESA funds to pay for the costs of books and educational supplies, subscriptions to education publications, and/or teaching materials. Allowable uses also include computer hardware, monitors, mice, devices, software, Internet connections, or cable costs.

When something may also do double-duty as a toy or entertainment device, you’ll need to be very specific about why and how the item is used in the classroom. In fact, if you are using those items for both education and personal use (or even for business use), you may need to keep a log. You will have to allocate deductible costs based on percentage of education use, business use, and personal use.

Additional tax considerations

That delightfully generous $250 deduction for educator expenses is not permitted for homeschooling. The IRS specifically points that out in the instructions to the Form 1040, page 27.

People have asked me if they can take an office-in-home deduction for homeschooling their children. While there is no specific reference in IRS publications or the Tax Code to address this, let’s follow a logical train of thought. In order to claim an office-in-home deduction you must be either an employee of a business or an owner of a business. Teaching your children at home is not a business.

The fact is, there are not many tax benefits for an individual home school. However, a group of parents may be able to form their own small private school, get accreditation from a state, and register as a school and as a non-profit organization. If you do that, you’ll open the door to other tax reduction opportunities.

READ MORE:

Best Tax Tips: The Tax Effects of School Supplies and Courses

2012 Standard Mileage Rate: How it affects Your Business Vehicle

Entrepreneurs and Start-Ups: Best Tax Tips

August 2011 Summer Tax-Free Days

Common Mistakes the Self-Employed Make

How Divorce Affects Your Tax Return

Sales Tax – Are All Those Receipts Worth Saving?

Eva Rosenberg, EA is the publisher of TaxMama.com , where your tax questions are answered. Eva is the author of several books and ebooks, including the new edition of Small Business Taxes Made Easy. Eva teaches a tax pro course at IRSExams.com and tax courses you might enjoy at http://www.cpelink.com/teamtaxmama.